But! My father used to tell me everything before the word but is bullshit!

需要有美國的Active License!更仔細地說是需要Member of a Recognized U.S. State Board of Accountancy 出具一份letter of good standing(什麼都要錢USD 25),前提就是你需要有Active License

下面就來分享一下申請Active License的攻略吧!

Active License也就是license to practice,除了一些州一申請就是active之外(例如:伊利諾州)

大家看到這裡,可能會悔恨當初選錯州了阿(我就很悔恨)

大家看到這裡,可能會悔恨當初選錯州了阿(我就很悔恨)到

底

在

瞎

忙

什

麼

?????

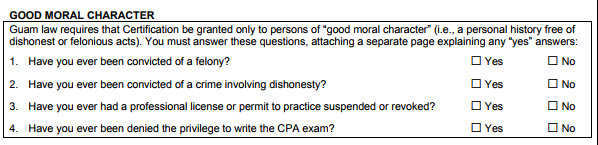

好!振作,首先要先知道各州的規定,以小弟有研究的關島來說,Active的申請是有工作經驗限制的

以下從Guam Board of Accountancy 官方網站FAQs節錄:

Answer: Successful Guam CPA exam candidates must have at least 150 semester hours of education and one year of work experience to qualify for issuance of an active Guam CPA license; successful candidates with less than 150 semester hours of education that met Guam's educational requirements prior to sitting for and passing the CPA exam must have two years of work experience to qualify for an active Guam CPA license; successful candidates that met Guam's educational requirements prior to sitting for and passing the CPA exam but not having met Guam's work experience requirement may qualify for issuance of an inactive Guam CPA license. Acceptable work experience may be gained through government, industry, academia, or public practice employment under the supervision of an actively licensed CPA in the jurisdiction of licensing. Work experience must be verified by an actively licensed CPA, and must have been obtained within five years of applying for a Guam license to be acceptable for licensing purposes. NOTE: an active "attest" license requires at least 1,000 hours of "attest" experience under the direct supervision of an actively licensed CPA authorized to perform attest services.

紅色字的部分,是指如果還沒有足夠的工作經驗,僅可申請inactive license。

藍色字的部分,是指相關工作經驗的獲取來源並且需要由擁有active license 的CPA管轄。

紫色字的部分,是指工作經驗要由actively licensed CPA幫你認證。

那麼一般在會計師事務所工作的工作經驗,都是可以認證的,前提是要找到擁有active license 的CPA,幸好在台灣四大事務所,應該多多少少都有會計師是符合資格的,以我本身D所來說,HR那邊就有這種認證服務可以申請,請洽各所的HR詢問看看!

下面是從申請表格中的Experience Affidavit裡面節錄出來的申請資格

an applicant must provide evidence of Two Years’ Experience (minimum of 4,000 hours) or One Years’ Experience plus 150 hours of education, obtained over a period of not less than one (1) year nor more than five (5) years of employment. Experience may consist of providing any type of services or advice using accounting, attest, compilation, management advisory, financial advisory, tax or consulting skills in industry, government, academia or public practice. An Attest license requires a minimum of 1,000 hours of attest experience directly supervised by a licensee authorized to perform attest work. Experience must be verified by a holder of a valid CPA license issued by one of the 55 Board jurisdictions.

上面的條件應該很清楚,重點是紅色字的部分,不用限定關島的會計師幫你認證工作經驗。

NASBA也有提供認證工作經驗的服務(如下網址),不過還是要錢($700 for international candidates)

https://nasba.org/products/experienceverification/

接著我們看下一篇繼續申請流程

https://ericcire318.blogspot.com/2017/10/uscpa-active-licenseguam-part-2.html